Homeowners Insurance in and around Terrell

Homeowners of Terrell, State Farm has you covered

Help cover your home

Would you like to create a personalized homeowners quote?

What's More Important Than A Secure Home?

It's so good to be home, especially when your home is protected by State Farm. You never have to worry the unpredictable with this fantastic insurance.

Homeowners of Terrell, State Farm has you covered

Help cover your home

Agent Travis Wilson, At Your Service

If you're worried about navigating life's troubles or just want to be prepared, State Farm's terrific coverage is right for you. Constructing a policy that works for you is not the only aspect that agent Travis Wilson can help you with. Travis Wilson is also equipped to assist you in filing a claim if something does happen.

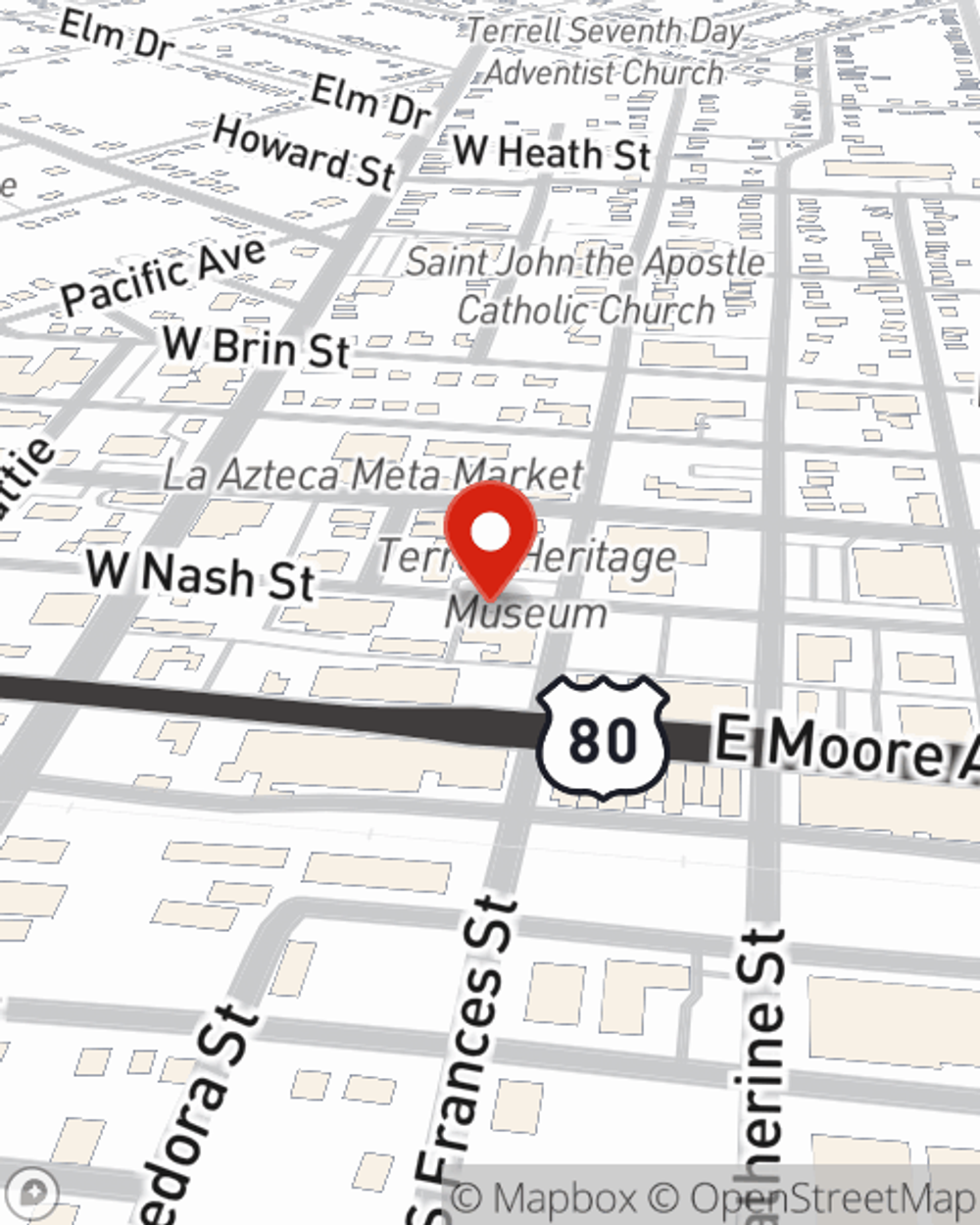

Contact State Farm Agent Travis Wilson today to see how an industry leader in homeowners insurance can help protect your house here in Terrell, TX.

Have More Questions About Homeowners Insurance?

Call Travis at (972) 563-1500 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Extension cord safety: What to do and what to avoid

Extension cord safety: What to do and what to avoid

An extension cord is handy to have in the home or office, but without caution it can become a fire hazard. Here are tips for using an extension cord safely.

Travis Wilson

State Farm® Insurance AgentSimple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Extension cord safety: What to do and what to avoid

Extension cord safety: What to do and what to avoid

An extension cord is handy to have in the home or office, but without caution it can become a fire hazard. Here are tips for using an extension cord safely.